Payment systems are a fundamental part of our daily lives, allowing us to conduct financial transactions efficiently and securely. From traditional cash transactions to modern digital payment systems, payment methods have evolved significantly over time, revolutionizing the way we do business and interact with each other.

In today’s digital age, the ability to process payments quickly, securely, and seamlessly is essential for businesses to succeed. A reliable payment system is the backbone of any commercial activity, enabling businesses to accept payments from customers, pay suppliers, and manage their finances effectively.

The importance of payment systems extends beyond individual transactions. Efficient payment systems contribute to the growth of the economy, facilitate trade, and enhance financial stability. Payment systems also play a critical role in promoting financial inclusion, enabling people to access financial services regardless of location, income, or background.

Efficient payment systems contribute to the growth of the economy, facilitate trade, and enhance financial stability.

Payment processing has evolved significantly over time, from simple bartering and cash transactions to the digital payment methods that are prevalent today. In the past, payments were typically made with physical currency, with limitations such as security risks and the need for physical exchange. With the advent of technology, payment processing has become more efficient and secure, with the development of electronic payment methods such as credit and debit cards, online payment gateways, and mobile payment apps. These new payment methods have greatly expanded how businesses and consumers can transact, making it easier, faster, and more secure to make and receive payments.

Current payment processing methods and their pros and cons.

There are several payment processing methods available today. Here are some of the most common ones, along with their pros and cons:

Credit and Debit Cards

This is the most common payment method used in most businesses. Customers swipe or insert their card, and the transaction is processed through a card network like Visa, Mastercard, or American Express.

Pros:

- Widely accepted and convenient for customers

- Ensures secure transactions for customers

- Offers cashback or rewards to customers

Cons:

- May have high processing fees for businesses

- Chargebacks can be a headache for merchants

- Credit card fraud can be a concern

Mobile Payments

This newer payment method allows customers to pay using their mobile devices, typically through an app or wallet. Examples include Apple Pay, Google Pay, and Samsung Pay.

Pros:

- Fast and convenient for customers

- Enhanced security beyond traditional payment methods

- Easy to track transactions and receipts

Cons:

- Not all businesses accept mobile payments

- May require a compatible device or app to use

- May have limited customer adoption

Online Payment Gateways

This payment processing method allows businesses to accept payments online, typically through a website or e-commerce platform. Examples include PayPal, Stripe, and Square.

Pros:

- Easy to set up and use for businesses

- Widely accepted and convenient for customers

- Can provide fraud detection and prevention tools

Cons:

- May have higher processing fees than other methods

- Chargebacks can still be an issue

- Customers may be hesitant to share personal information online

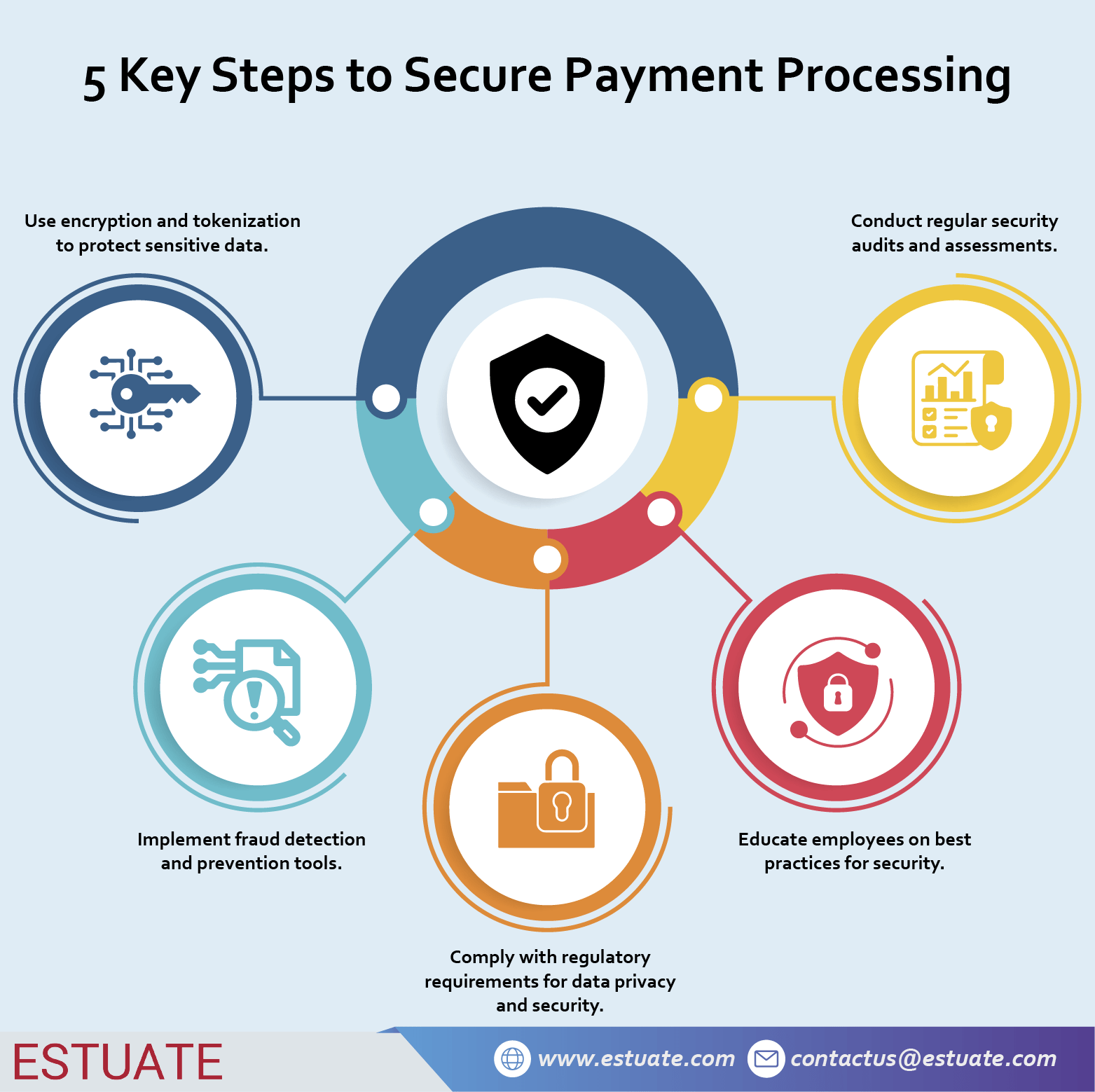

Secure Your Payment Processing: 5 Key Steps to Protect Your Business and Customers

Security is a major concern in payment processing, with the risk of fraud, hacking, and data breaches. Payment processors are responsible for ensuring that their systems and processes are secure, but businesses also need to take steps to protect their customers’ information. This includes using encryption, tokenization, and other security measures to protect sensitive data, as well as implementing fraud detection and prevention tools. Businesses also need to comply with regulatory requirements related to data privacy and security, such as the Payment Card Industry Data Security Standard (PCI DSS).

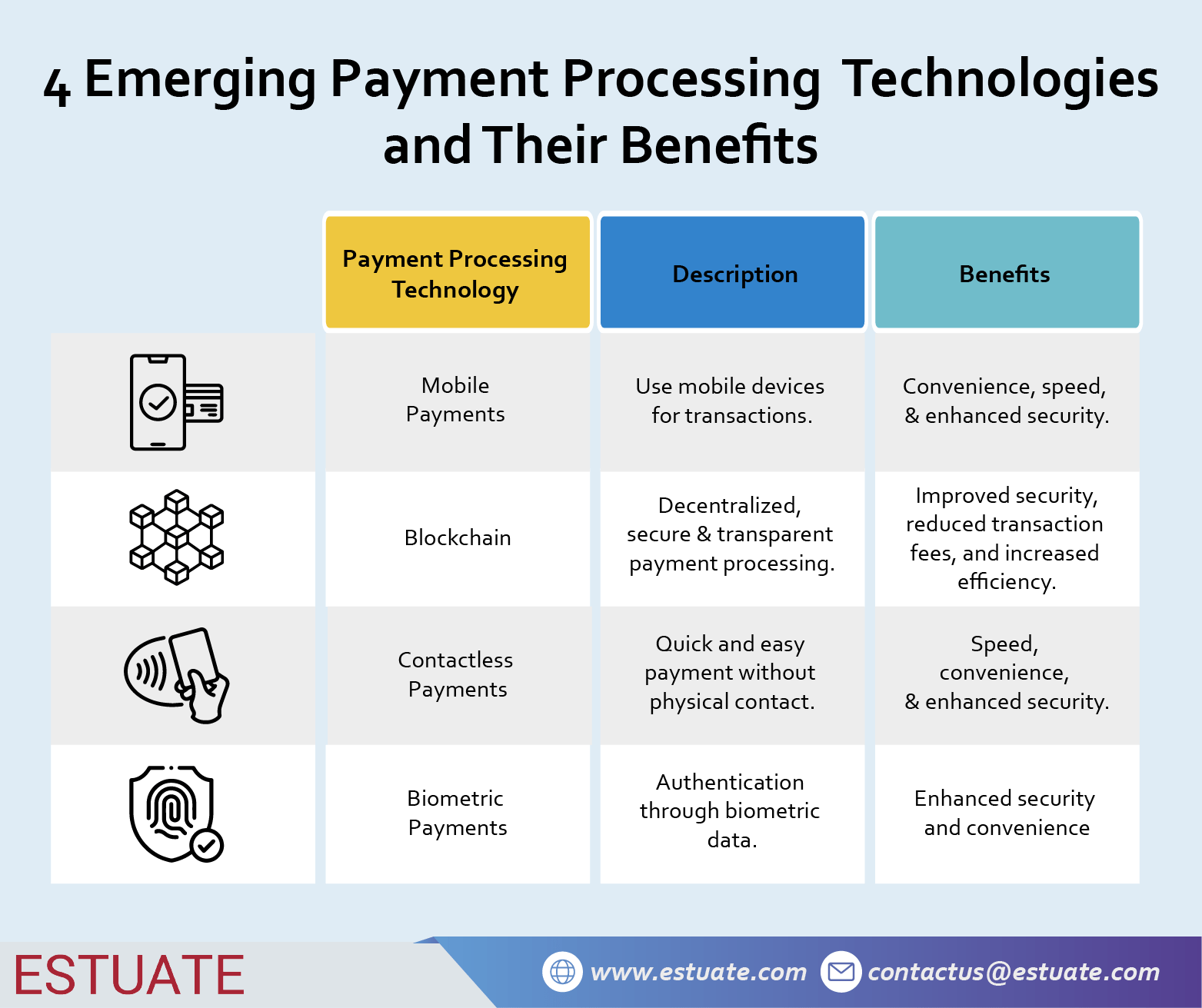

Emerging payment processing technologies: benefits, impact, and challenges.

Emerging payment processing technologies are poised to revolutionize the way we make and receive payments. Here are some of the most promising technologies and their benefits:

Mobile Payments

Mobile payment technologies like Apple Pay, Samsung Pay, and Google Wallet allow consumers to make payments using their mobile devices. Benefits include convenience, speed, and enhanced security.

Blockchain

Blockchain technology provides a decentralized, secure, and transparent way to process payments. Benefits include improved security, reduced transaction fees, and increased efficiency.

Contactless Payments

Contactless payment technologies like NFC and RFID allow for quick and easy payments without the need for physical contact. Benefits include speed, convenience, and enhanced security.

Biometric Payments

Biometric payment technologies use biometric data such as fingerprints, facial recognition, or voice recognition to authenticate payments. Benefits include enhanced security and convenience.

The impact of these technologies on the payment processing industry is significant, as they can greatly improve efficiency, security, and convenience for businesses and consumers. However, there are also challenges to implementing these technologies, including the need for infrastructure updates, user adoption, and regulatory compliance. Despite these challenges, the future of payment processing looks promising with the emergence of these new technologies.

Emerging payment processing technologies: benefits, impact, and challenges.

The payment processing industry is rapidly evolving, and there are several key trends shaping its future. Here are some of the most important trends and their impact:

Digital Payments

The move towards digital payments continues to accelerate, with more consumers using mobile wallets, online payment gateways, and other digital payment methods. This trend is driven by the increasing use of smartphones, e-commerce, and the need for contactless payments in the wake of the COVID-19 pandemic.

Payment Security

Payment security is a top priority for businesses and consumers, and there is a growing demand for secure payment processing methods. The adoption of technologies such as encryption, tokenization, and biometric authentication is helping to address these concerns.

Payment Integration

There is a trend towards payment integration, with businesses looking to streamline payment processing and reduce costs by integrating payment systems with other business software and tools.

Personalization

There is a growing demand for personalized payment experiences, with consumers expecting customized payment options and user interfaces that reflect their preferences.

Discover the latest payment processing technologies and their benefits.

These trends are having a significant impact on businesses and consumers, with businesses needing to adapt to changing consumer preferences and expectations. The move towards digital payments and payment integration is helping businesses to improve efficiency and reduce costs, while the focus on payment security and personalization is helping to build consumer trust and loyalty. Overall, the payment processing industry is undergoing a major transformation, and businesses that stay ahead of these trends will be better positioned to succeed in the future.

In conclusion, payment processing is a critical function for businesses and consumers alike, and it is constantly evolving with new technologies and trends. Businesses that stay updated with the latest payment processing technologies will be better positioned to improve efficiency, reduce costs, and build consumer trust and loyalty. Key trends shaping the payment processing industry include the move towards digital payments, payment security, payment integration, and personalization.

As a business owner or manager, it’s important to evaluate your payment processing needs and adopt the right payment processing method for your business. This may involve upgrading your payment processing infrastructure, integrating payment systems with other business software and tools, or implementing new payment security measures. By staying updated with the latest payment processing technologies and trends, you can position your business for success in the rapidly evolving payment processing landscape.

Therefore, we encourage businesses to act now and adopt the right payment processing method that suits their needs. By doing so, they can enhance the payment experience for their customers, improve operational efficiency, and stay ahead of the competition in today’s digital world.

At Estuate, we have extensive expertise in payment processing technologies, including Stripe. With our help, businesses can take advantage of the latest digital payment solutions to improve efficiency, reduce costs, and enhance the customer experience. Our team of experts can help you evaluate your payment processing needs and develop a customized payment processing solution that meets your business requirements. Whether you need to integrate Stripe with other business software and tools, implement new payment security measures, or streamline payment processing, we have the expertise to help you succeed. With Estuate, you can stay updated with the latest payment processing technologies and trends, and position your business for success in the rapidly evolving payment processing landscape.

If you’re interested in learning more about how Estuate can help your business with new-age digital payment solutions, contact us today to schedule a consultation with one of our payment processing experts.