Insurance in the Digital Age: Top Trends and Priorities for 2023

As the world becomes increasingly digitized, the insurance industry has had to adapt and evolve to meet the changing needs of consumers. Gone are the days of paper policies and manual claims processing. Today, insurance companies are using advanced technology and data to offer customized coverage and real-time assistance to their customers. This transformation has been a journey, requiring collaboration between insurers, tech companies, and regulatory bodies. And while we can’t predict exactly what the future holds for insurance in the digital age, one thing is certain: it’s an exciting time to be a part of the industry.

As the insurance industry works to keep up with the evolving expectations of customers, many are finding that digital transformation is the key to success. According to Gartner research, this shift is already paying off, with the industry seeing strong long-term growth and spending expected to increase at a compound annual growth rate (CAGR) of 7.5% to reach $311.8 billion in 2025. Insurance companies that are proactive in adopting new technologies and processes will be best positioned to thrive in this rapidly changing landscape.

This growth is being driven by increased investments in IT services and software, which are expected to grow at CAGRs of 9.2% and 12.3%, respectively. These investments in data, AI, and digital twin technologies are enabling the emergence of a new generation of business and intelligence within the insurance industry. The adoption of these technologies is crucial for insurance companies to keep pace with the changing demands of the market and remain competitive in the digital age.

So, what are the key areas of focus when it comes to digital transformation in the insurance industry? Here are some potential priorities for 2023:

- Customer Experience

- Data Analytics

- Digital Distribution

- Risk Management

- Process Automation

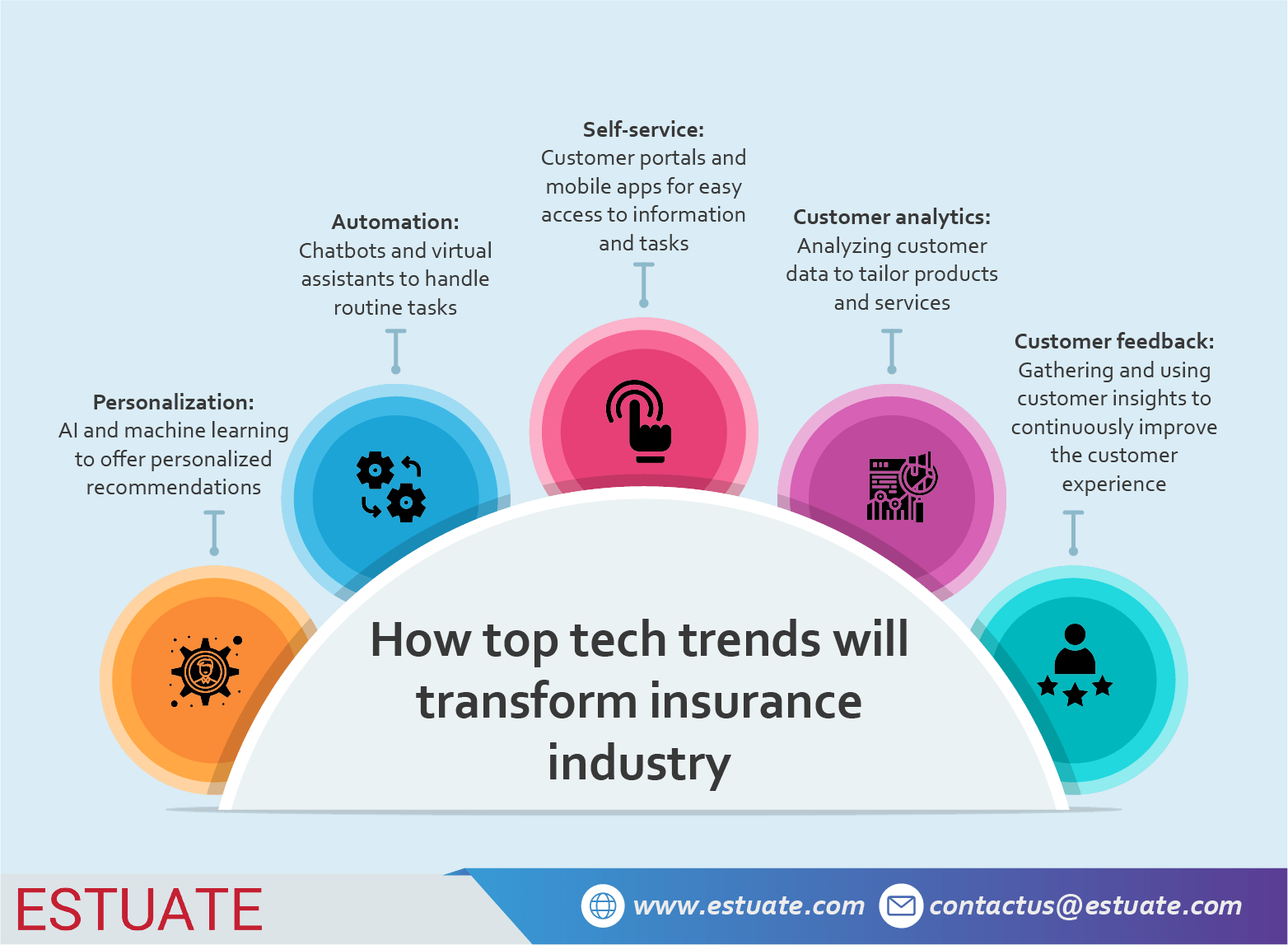

The insurance industry is embracing technology to improve customer experience in 2023

What comes to mind when you think about your interactions with your insurance company? Do you feel like just a policy number, or do you feel like a valued customer? For the insurance industry, the answer to this question is crucial. That’s why customer experience is a top priority. From the moment you first contact an insurance representative to when your claim is processed, the insurance industry is working hard to ensure that your experience is positive, seamless, and stress-free.

Improving the customer experience is likely a top priority for many insurance companies in 2023. This could involve using artificial intelligence and machine learning to personalize recommendations, automating manual processes to improve efficiency, or using chatbots and virtual assistants to provide instant support.

For example, an insurance company could use machine learning to analyze customer data and provide personalized policy recommendations based on an individual’s specific needs and risk profile.

Additionally, automating manual processes such as claims handling or policy renewals can help reduce turnaround times and improve the overall customer experience. Chatbots and virtual assistants can also be useful in providing instant support and answering customer questions, which can be especially valuable in the age of social media and online reviews.

The many benefits of investing in Customer Experience in the Insurance Industry

The role of data analytics in the insurance industry in 2023

Imagine you’re an insurance company trying to offer your customers the best products and services. How do you know what they want and need? That’s where data analytics comes in. Insurance companies can get a clearer picture of their target market by collecting and analyzing data on customer behavior, preferences, and demographics. They can use this information to understand customer needs and identify trends, helping them to make more informed decisions about product development and marketing strategies.

For example, an insurance company might use data analytics to discover that a particular group of customers is more likely to purchase a certain type of coverage. They might also learn that certain marketing channels are more effective at reaching certain market segments. By understanding these trends, insurance companies can tailor their offerings and outreach to meet their customers’ needs better.

Insurance companies collect a vast amount of data from their customers and using that data to make informed decisions can be a powerful tool. In 2023, insurance companies may prioritize investing in data analytics capabilities to understand customer needs better, identify trends, and make more accurate risk assessments.

In 2023, insurance companies may prioritize investing in data analytics capabilities to understand customer needs better, identify trends, and make more accurate risk assessments.

Digital distribution through online and social media channels is critical for the insurance industry in 2023

In the age of online shopping and remote work, insurance companies need to be able to reach customers where they are. This may involve developing or improving online portals for purchasing and managing policies and leveraging social media and other digital channels to engage with customers.

For example, an insurance company could create a mobile app that allows customers to purchase policies, file claims, and access policy information on the go.

Additionally, social media platforms can be a valuable channel for insurance companies to connect with customers, share information, and address any concerns or questions they may have.

Risk management is a key focus for the insurance industry in the coming year

Insurance is all about managing risk; using technology to understand and mitigate risk can be a major advantage. In 2023, insurance companies may focus on using sensors, IoT devices, and other technologies to gather real-time data on potential risks and develop more effective risk management strategies.

For example, an insurance company could use sensors to monitor the condition of a building and identify potential risks such as water leaks or structural issues. This information could then be used to develop preventative measures or tailor insurance policies to meet individual customers’ needs better.

Insurance industry prioritizes process automation in 2023: why is it a top priority?

Insurance companies often have complex, manual processes that can be time-consuming and prone to errors. Automating these processes can help improve efficiency and reduce costs, making it a top digital transformation priority for many insurers in 2023.

For example, an insurance company could use process automation to streamline the claims handling process, allowing claims to be handled more efficiently and with fewer errors. This could involve using artificial intelligence to analyze claims data and identify potential issues or automated processes to route claims to the appropriate team for review.

Overall, the most likely digital transformation priorities for the insurance industry in 2023 depend on individual companies’ specific needs and goals. However, the above trends are likely among the most significant drivers of change in the industry in the coming years.

Ultimately, insurance companies’ specific digital transformation priorities in 2023 will depend on their individual needs and goals. However, the above trends are likely among the most significant drivers of change in the industry over the coming years.

To stay competitive and meet customer needs, insurance companies are focusing on customer experience, data analytics, digital distribution, risk management, and process automation.

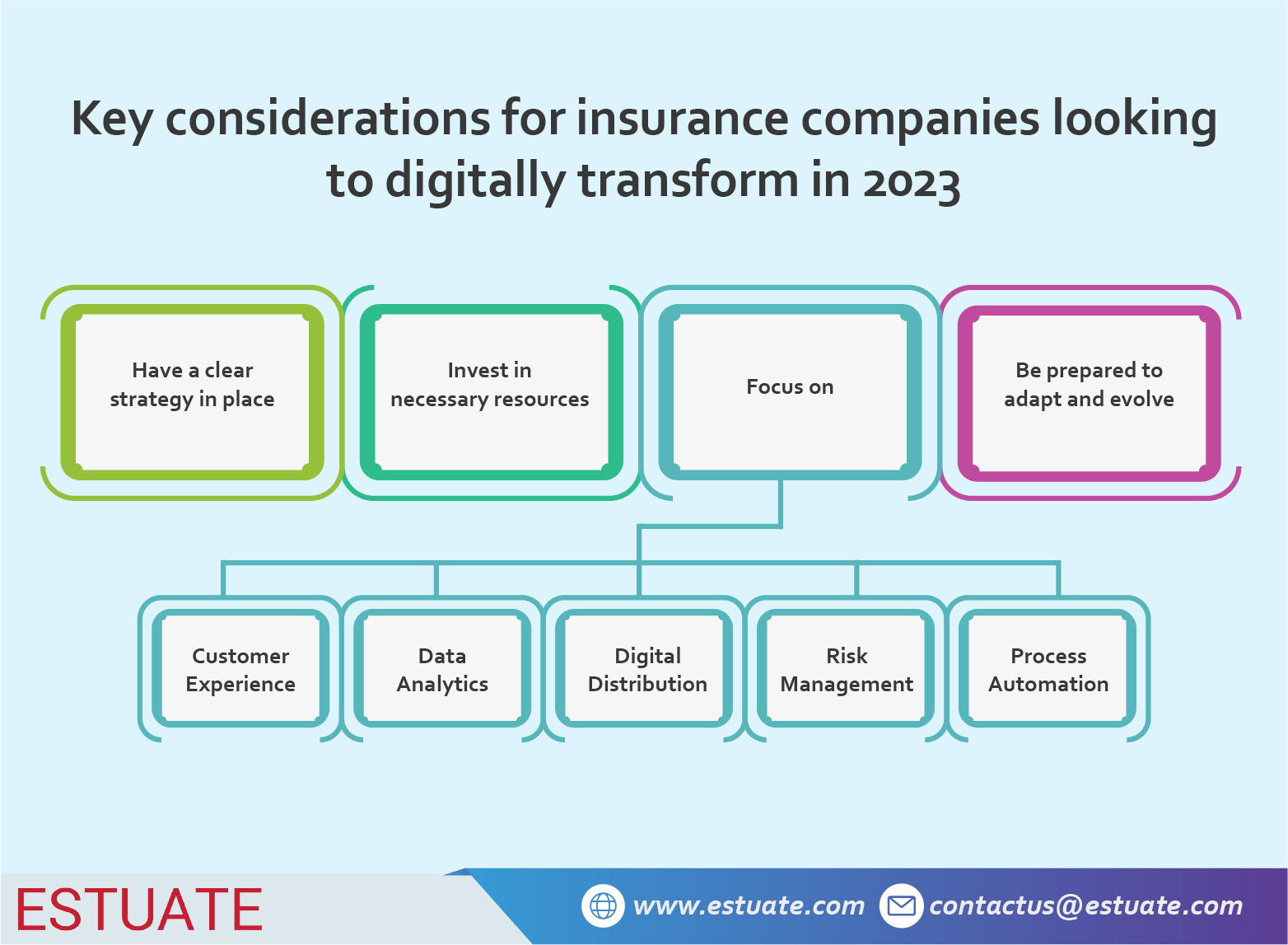

In addition to the priorities listed above, there are a few other key considerations for insurance companies looking to transform digitally in 2023.

Key considerations to digitally transform your insurance company in 2023 and beyond

First, insurance companies need to have a clear strategy in place. This should involve setting specific goals, identifying the technologies and processes that will help achieve those goals, and establishing a timeline for implementation. With a clear strategy, it can be easier for insurance companies to implement and manage digital transformation initiatives effectively.

Second, insurance companies should be prepared to invest in the necessary resources to support digital transformation. This may include investing in new technologies, hiring specialized staff, or training current employees to use new tools and systems. While investing in digital transformation can be costly, it can also pay off in the long run by improving efficiency, reducing costs, and increasing customer satisfaction.

Finally, insurance companies should be prepared to adapt and evolve as the industry changes. Digital transformation is an ongoing process, and insurance companies that can quickly adapt to new technologies and trends will likely have a competitive advantage. This may involve regularly reviewing and updating their digital transformation strategy and being open to new ideas and approaches.

In conclusion, digital transformation will be an essential priority for insurance companies in 2023. By focusing on customer experience, data analytics, digital distribution, risk management, and process automation, insurance companies can better meet the needs of their customers, improve efficiency, and stay competitive in an increasingly digital world.

Effortlessly navigate digital transformation in the insurance industry with Estuate

Estuate is committed to helping insurance enterprises modernize their operations and stay competitive in today’s market. Our key offerings include data and analytics services, subscription billing and revenue management, governance, risk & compliance support, product engineering, and managed services.

Contact us for more information on Estuate’s services for your insurance business. We can help you find the best solution for your needs.