Why modernize your subscription business?

The subscription economy is a constantly evolving space. Earlier, subscription models were mostly restricted to magazines, newspapers, utilities, and telecommunication services. But, subscription offerings have grown exponentially over the years. Today, a robust subscription management platform is critical to start growing your subscription business. And, a Zuora partner is the rest you need to bring out the best from the same.

The global subscription and billing management market is expected to reach $10.5 billion by 2025.

Technology has been a game-changer in how subscription businesses are managed worldwide. It has transformed how recurring revenue businesses monetize billing and streamline revenue. More and more businesses are digitizing their subscription activities today. So in times such as these, it becomes pertinent to know: how to modernize my subscription business. In other words, it becomes pertinent to zero in on a subscription management platform.

How to modernize your subscription business?

- Engage the power of e-commerce

- Make personalized offerings

- Adopt a faster quote-to-cash mechanism

- Implement seamless subscription billing

- Automate subscription revenue generation

- Improve payment mechanisms

- Leverage enhanced analytics

1. Engage the power of e-commerce

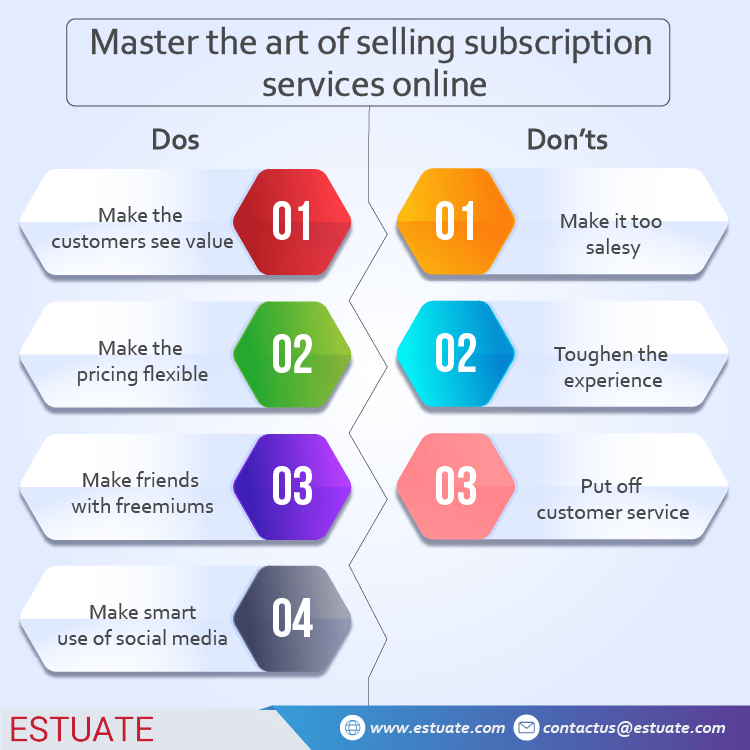

The global subscription e-commerce market size is expected to reach $904.2 billion by 2026. Subscription businesses are entering into e-commerce through web-based subscription sites and mobile applications. Online stores allow businesses to offer more products and services and engage more customers. This results in a win-win situation for both sellers and buyers. Being a proven method for lead generation, this is an excellent way to modernize subscription businesses. A Zuora partner can help get you there via synchronized adaptations.

2. Make personalized offerings

Technology has made subscription businesses highly flexible. Now you can offer weekly, monthly, or annual subscriptions for your products and services based on customer preferences. Also, it is much easier today to cancel, renew, or upgrade subscriptions anytime. By automating subscription management, you modernize your subscription business. You don’t have to worry about keeping a track of your customer’s preferences or changes in plans. It results in higher customer satisfaction as well as simplicity in operations.

Today’s subscription market is a high-competition one. Here are some handy tips to get robust ROI from your subscription business despite the changing field dynamics.

3. Adopt a faster Quote-to-Cash mechanism

Traditional subscription models involve lengthy and time-consuming processes to convert orders to cash. Modern subscription management solutions automate your Quote-to-Cash process. It helps you manage orders, leverage workflows, and join the dots faster from order to cash. This in turn enables faster revenue recognition.

4. Implement seamless subscription billing

New-age subscription models are designed to manage recurring billings effectively within a single platform. Automated subscription management helps you generate invoices, notify customers, deduct payments, and customize subscriptions as required. Also, they allow you to manage a range of product categories and billing cycles effortlessly with end-to-end subscription management features.

A PCI-DSS-compliant Zuora partner can bring forth synchronization in your billing and revenue operations while simultaneously adhering to the payment card industry regulations. It a smart move to modernize your subscription business with industry-efficient operations.

A subscription management platform can help you achieve all of these and more.

5. Automate subscription revenue generation

Easy revenue recognition speeds up ROI generation. A Zuora Revenue partner can help you automate your revenue operations. It helps you modernize all quarters of your revenue management process from consulting to deployment. This facilitates smooth audits of functional, technical, and conversion design documents. You can configure your revenue management systems and opt for inbound and outbound data integrations. A capable Zuora partner can also streamline incident tracking and issue resolution for you.

6. Improve payment mechanisms

Gone are the days when you lost revenues because of failed payment mechanisms. Modern subscription platforms help you monetize your recurring billings and manage revenues effectively. Today, you can introduce multiple payment options and adopt more efficient payment gateways. You can also notify your customers immediately when a payment has failed and reprocess it in time.

7. Leverage enhanced analytics

Traditional subscription models lack a mechanism for tracking daily operations and analyzing business performance. With the best practices in subscription management, you can generate custom reports, measure the performance of individual product lines, and improve decision-making. With advanced analytics, you can modernize your subscription business, channel your marketing strategies, and improve performance to achieve business goals efficiently.

Zuora is the world’s leading subscription management platform

Zuora is the subscription economy pioneer and is the most robust subscription management platform in the world. Choosing a Zuora partner for streamlining your subscription business is an ROI-driving decision.

Estuate is the most trusted Zuora implementation partner

We at Estuate host a dedicated Zuora center of excellence. We are PCI-DSS compliant. And, our Zuora-certified experts are champions in driving digital transformation in subscription businesses across verticals, around the world. Be it for Quote-to-Cash management needs or recurring revenue automation support, we are equipped to modernize your subscription business. We are Zuora’s most trusted consulting and implementation partner.

Check out our Zuora Billing services, visit us here

For our Zuora Revenue solutions, drop in here

So if you need any help in archiving your ERP data, know that we’re just this click away.

What are you doing to make your subscription business model stand out? Do you think a subscription platform enabler can help? Let us know on LinkedIn, Twitter, or Facebook. We would love to hear from you!