Artificial intelligence (AI) is changing the game in the financial sector, allowing institutions to craft personalized products and services that cater to the distinct needs of their customers. By tapping into advanced data analytics, machine learning, and natural language processing, banks and financial organizations can dive deep into customer behaviors and preferences. In today’s fast-paced world, this shift to personalized finance isn’t just a nice-to-have; it’s a vital necessity. As customer expectations evolve, financial institutions that adapt are the ones that will thrive in an increasingly competitive market.

Gone are the days of the traditional one-size-fits-all approach. Today’s customers want financial solutions that align with their unique goals and situations. For example, AI algorithms can sift through extensive transaction data, offering insights that allow banks to segment their customer base and provide targeted products. McKinsey highlights that companies excelling in personalization generate 40% more revenue from these activities than their less personalized competitors. That’s a powerful statistic underscoring the importance of tailored services!

But AI’s potential goes beyond simply recommending products. It empowers financial institutions to understand their customers’ life stages better, enabling timely and relevant financial advice. Whether it’s guiding a young professional through student loan options or assisting an older client with retirement planning, this proactive engagement helps foster loyalty—customers feel understood and valued.

As AI continues to gain traction in the financial world, institutions are not only boosting operational efficiency; they’re also redefining what customer experience looks like. AI-driven personalized finance means smoother interactions, predictive insights, and tailored financial strategies. For instance, AI chatbots provide real-time assistance, guiding customers in managing their finances while offering recommendations tailored to their unique spending habits.

The Power of Personalization in Finance

Personalized finance isn’t just a trend; it’s essential in today’s competitive landscape. According to Salesforce, 70% of consumers say a company’s understanding of their personal preferences greatly influences their loyalty. In finance, that means moving beyond generic offerings to cater specifically to individual needs. AI enables banks and financial services to analyze massive amounts of customer data—like spending patterns, transaction history, and financial objectives—to deliver tailored solutions that resonate with each client.

A study by Accenture reveals that 83% of consumers are willing to share their data for personalized offers. This growing openness to sharing information presents an invaluable opportunity for financial institutions to deepen their customer relationships and enhance their offerings.

How AI is Driving Personalization

As customer expectations evolve, so too must the strategies that financial institutions employ to engage their clientele. Artificial intelligence is at the forefront of this transformation, enabling banks and financial services to move beyond generic offerings and truly connect with their customers. By leveraging AI technologies, institutions can gain valuable insights into customer preferences, behaviors, and needs, paving the way for tailored experiences that resonate on a personal level. Let’s explore how AI is actively driving this shift toward personalization across various facets of financial services.

1. Customer Segmentation and Behavioral Analysis

AI algorithms are experts at dissecting large datasets to uncover patterns and trends. Financial institutions can harness these algorithms to effectively segment customers based on their behaviors and preferences. For instance, AI can identify which customers may seek investment advice, which are interested in savings plans, or which may need help managing debt. This insight allows banks to tailor their marketing strategies, product offerings, and customer interactions accordingly.

Imagine a customer who frequently engages in international transactions receiving targeted offers for foreign exchange services or travel-related financial products. This level of personalization enhances the overall banking experience.

2. Smart Product Recommendations

AI-powered recommendation engines analyze customer behavior in real-time to suggest relevant products and services. If a customer often uses credit for purchases, an AI system might recommend a credit card offering cash back on those specific transactions. Similarly, if a client expresses interest in eco-friendly investments, AI can highlight sustainable funds or green investment options.

According to McKinsey, personalized recommendations can boost sales by **10-30%**, highlighting the substantial impact AI has on enhancing product offerings and improving conversion rates.

3. Dynamic Pricing and Offers

AI enables financial institutions to implement dynamic pricing models that adjust offers based on customers’ financial histories, credit scores, and behaviors. For instance, customers with strong credit histories might receive lower interest rates on loans or exclusive offers on financial products. This tailored pricing not only attracts customers but also builds trust and loyalty, as clients feel recognized and appreciated.

AI can also predict optimal times for promotional offers based on customer behavior patterns, maximizing engagement and satisfaction.

4. Enhanced Customer Service with Chatbots

AI-driven chatbots are revolutionizing customer service in finance, providing instant support tailored to individual needs. These chatbots can answer inquiries, provide financial advice, and even assist users in navigating complex financial products. Leveraging natural language processing (NLP) and machine learning, chatbots understand customer inquiries and respond with personalized solutions.

A report by Juniper Research anticipates that chatbots in banking will save institutions over $7.3 billion annually. This not only cuts costs but also enhances customer engagement, as clients gain immediate assistance around the clock.

5. Financial Planning and Advisory Services

AI is reshaping wealth management by offering personalized financial planning services. Robo-advisors use algorithms to assess individual risk tolerance, financial goals, and investment preferences, providing tailored investment strategies that align with each client’s needs. These AI-driven platforms are not only cost-effective but also democratize access to personalized financial advice, making it available to a broader audience.

Clients can receive customized investment strategies based on their unique aspirations—whether saving for retirement, planning for a child’s education, or aiming for long-term growth. This level of personalization can significantly boost customer trust and engagement.

6. Risk Assessment and Fraud Detection

AI also plays a critical role in risk assessment and fraud detection, enhancing personalization in financial services. By analyzing transaction patterns and customer behavior, AI can identify anomalies that may signal fraud, enabling institutions to act swiftly. For instance, if a customer typically makes purchases in a specific region and suddenly attempts a transaction overseas, the AI system flags this as a potential risk.

Additionally, AI-driven risk assessment tools help financial institutions offer personalized loan products by evaluating an individual’s creditworthiness more holistically. This approach allows customers who may not fit traditional credit scoring models to access personalized financial products that meet their needs.

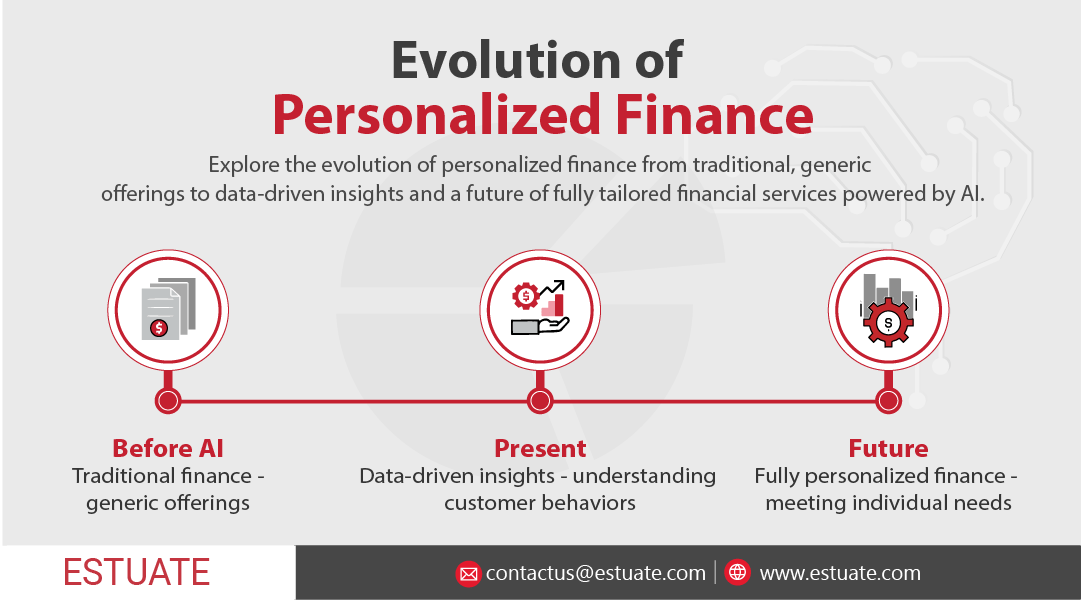

Evolution of Personalized Finance

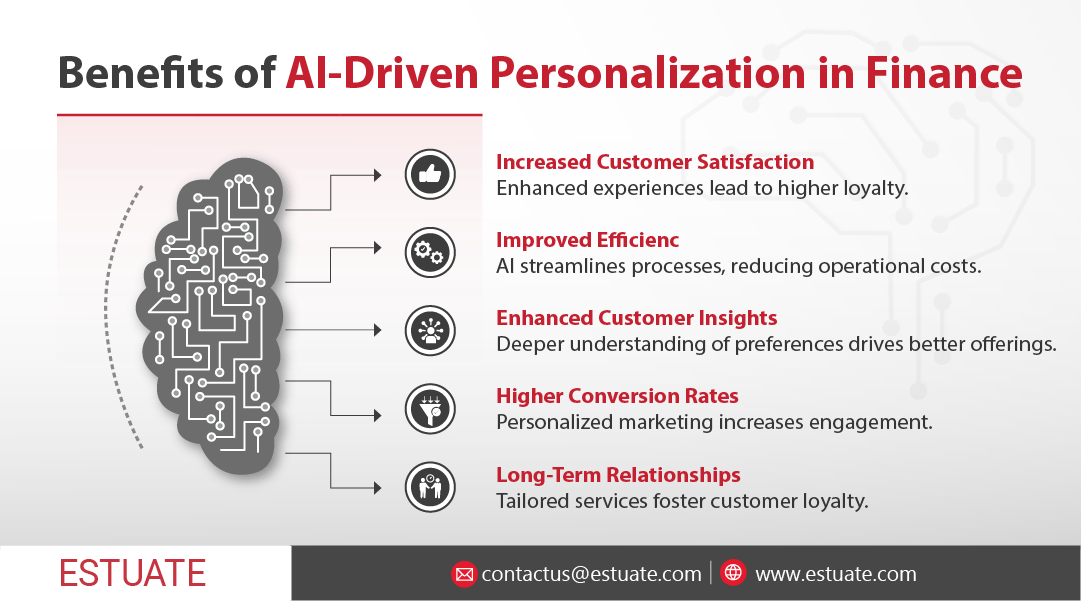

The Benefits of AI-Driven Personalization

The integration of artificial intelligence into financial services is not merely a trend; it’s a game changer that brings significant advantages for both institutions and their customers. By leveraging AI-driven personalization, financial institutions can create meaningful connections with clients, tailoring products and services to meet individual needs. This approach goes beyond traditional offerings, leading to enhanced customer experiences, improved operational efficiency, and stronger loyalty. Let’s delve into the multifaceted benefits of AI-driven personalization and see how it is reshaping the financial landscape for the better.

- Increased Customer Satisfaction: By offering personalized products and services, financial institutions can enhance customer experiences, resulting in higher satisfaction rates and increased loyalty.

- Improved Efficiency: AI automates many processes involved in personalizing financial services, allowing institutions to operate more efficiently and reduce operational costs.

- Enhanced Customer Insights: AI provides financial institutions with deeper insights into customer preferences and behaviors, enabling them to continuously refine their offerings.

- Higher Conversion Rates: Personalized marketing and product recommendations lead to higher conversion rates, as customers are more likely to engage with products that align with their interests.

- Long-Term Relationships: Tailoring services fosters long-term relationships with customers, contributing to greater lifetime value and reduced churn.

Benefits of AI-Driven Personalization in Finance

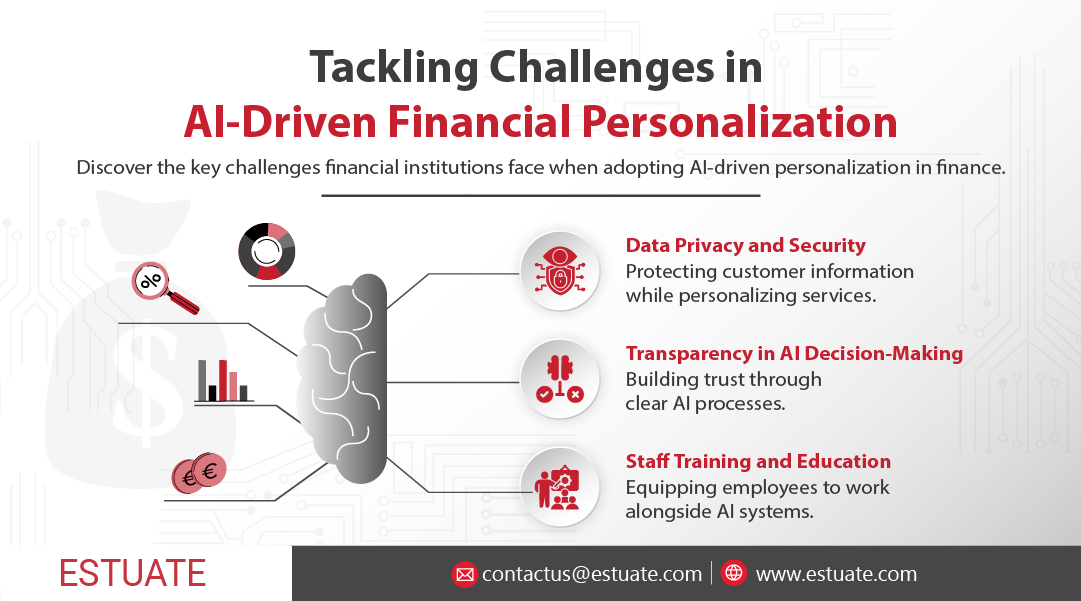

Challenges and Considerations

While the potential for AI in personalized finance is vast, challenges remain. Financial institutions must address data privacy and security issues, ensuring customer information is protected while still leveraging it for personalization. Additionally, maintaining transparency in AI decision-making processes is crucial for building trust with clients.

As financial services become increasingly reliant on AI, institutions also need to invest in staff training and education. Employees must understand how to collaborate with AI systems and interpret the insights provided by these technologies.

The impact of AI on personalized financial services is undeniable. As institutions harness the power of data-driven insights, they are creating tailored products and services that resonate with individual customers. By embracing AI, financial institutions not only enhance customer experiences but also position themselves as leaders in an increasingly competitive market.

As consumer expectations continue to evolve, the demand for personalized finance will only grow. Financial institutions that leverage AI effectively will undoubtedly lead the charge in reshaping the future of financial services. With AI steering the way, the path ahead is promising, guiding institutions toward a more personalized, efficient, and customer-centric future. By understanding and addressing individual needs, financial services can foster deeper connections with clients, ultimately driving growth and success in a rapidly changing landscape.

Tackling Challenges in AI-Driven Financial Personalization

Estuate’s AI and Automation Solutions

At Estuate, we understand that the future of financial services lies in personalization powered by advanced technology. Our AI and automation solutions are designed to help financial institutions harness the full potential of their data, enabling them to deliver tailored products and services that meet the unique needs of their customers

By partnering with Estuate, financial institutions can not only enhance their operational efficiency but also create meaningful connections with their customers through personalized experiences.

Ready to transform your financial services with AI and automation? Contact us today to learn more about how Estuate can help you achieve your personalization goals.